While today's lower than expected LTRO repayment news was largely a strawman set by misguided expectations set under the impression that Europe is fixed (it isn't), and that the ECB is willing to witdraw excess liquidity (it isn't as the result was a spike in the EURUSD so high it got quite a few political officials talking the EUR down to prevent an export-sector crunch), there is a bigger issue facing Europe in the context of liquidity, and that is a maturity cliff of some €1.7 trillion over the next 3 years.

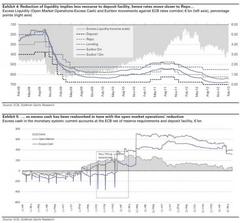

While today's lower than expected LTRO repayment news was largely a strawman set by misguided expectations set under the impression that Europe is fixed (it isn't), and that the ECB is willing to witdraw excess liquidity (it isn't as the result was a spike in the EURUSD so high it got quite a few political officials talking the EUR down to prevent an export-sector crunch), there is a bigger issue facing Europe in the context of liquidity, and that is a maturity cliff of some €1.7 trillion over the next 3 years.As the chart below from Goldman shows, the excess LTRO cash remaining after today is a modest €807 billion, meaning that not even half the required prepayment capital can be funded outright. It is even worse when calculating the closed European Excess System cash in the second chart below, which also according to Goldman has declined to just under €400 billion. This means that while rolling the maturing debt is certainly an option, the incremental pick up in interest rates will mean far more cash leaves Europe's banks, which at a time when virtually not a single European bank can generate any positive cash from operations bank liquidity shortages will once again return.

A bigger issue is what happens if the credit market shock of 2010 or 2011 or 2012, comes back and makes any rolling of debt if not impossible, then certainly unfeasible at realistic rates (especially now that the CDS market has been crippled for good as a hedge to long risk positions). In that case it will be up to the ECB to once more step up, and fill in the "maturity cliff" gap which is anywhere between €900 billion and €1.3 trillion. Unless, of course, the bank bailout provisions of the ESM are finally activated.

In either case, this goes directly to all short-sighted assumptions, that the ECB is willingly contracting its balance sheet: the last thing the central bank wants is to be seen as collapsing liquidity at a time when the debt prepayment calendar surges. Of course, there is one simple way to offset all such popular delusions: namely to force its balance sheet to soar again, which can be achieved in one of two ways - i) much more Long-Term (and other market) refinancing operations, or ii) outright sovereign bond monetization over Germany's screaming activist corpse.

And just as obvious is that both of those steps would require the creation of a controlled crisis, which will then most certainly not be allowed to go to waste. Reported by Zero Hedge 6 days ago.