Those who were transfixed by whether Cypriots would rumble and unleash their anger at the €300/day dispensing ATMs formerly known as bank branches this morning, may have missed what probably was the most important monthly chart coming out of Europe - that showing aggregate money (M3) growth and, far more importantly, loan creation. Those who did pay attention will know that in February M3 grew quite obediently in a Eurozone flush with cash, this time by a respectable €15 billion, or 3.1% y/y, after €37 billion in January (of which, however a whopping €47 billion was M1 so the balance actually declined). Of course, this was the easy part: creating money via various central bank conduits has never been the issue: *the concern has always been getting that money into private consumer hands through loan creation*.

Those who were transfixed by whether Cypriots would rumble and unleash their anger at the €300/day dispensing ATMs formerly known as bank branches this morning, may have missed what probably was the most important monthly chart coming out of Europe - that showing aggregate money (M3) growth and, far more importantly, loan creation. Those who did pay attention will know that in February M3 grew quite obediently in a Eurozone flush with cash, this time by a respectable €15 billion, or 3.1% y/y, after €37 billion in January (of which, however a whopping €47 billion was M1 so the balance actually declined). Of course, this was the easy part: creating money via various central bank conduits has never been the issue: *the concern has always been getting that money into private consumer hands through loan creation*.And it is here that things just keep on getting worse by the day. Because in a continent in which there is no confidence whatsoever: *no confidence in the banks, no confidence in the financial system, no confidence in end demand, no confidence in any reported data, no confidence that one's deposits won't be confiscated tomorrow, and last but not least no confidence that a sovereign nation won't just hand over its sovereignty to the Troika tomorrow, nobody is willing to take on additional loans and obligations*. This can be seen in the dramatic divergence between European money creation (blue line), and the bank lending to the private sector (brown), which is at or near an all time record year over year low. So much for restoring confidence in Europe.

SocGen explains this deplorable divergence:

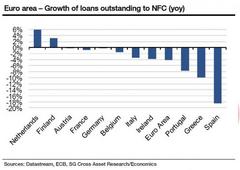

Loans to the private non-bank sector (adjusted for securitizations and sales) increased by a modest €6bn (after €-10bn in January). The yoy rate prints a tick up at -0.4%, but remains in negative territory. *On the details, signs of a credit crunch for corporates in the peripheral countries are materializing. *Loans to non-financial corporations (NFC) dropped by €9bn (-2.6% yoy) for the whole euro area but figures show strong heterogeneity within the euro area. In Spain, the outstanding value of loans to NFCs fell by 18.5%! Certainly, financing conditions for banks in southern European remain challenging, despite market improvements and this continues to point to tighter lending standards. However, there is little incentive to borrow in the current environment given the lack of confidence in future growth.

So where is said "credit crunch" the worst? Where else, but *Spain, Greece and Portugal *of course: the three countries that give the word "depression" a bad name.

Of course, one can now add Cyprus to the list: the country is about to see what trading away complete economic depression, sovereignty and even the smallest hope for an Icelandic recovery in order to remain a pawn in the hands of the EURocrats truly means. Reported by Zero Hedge 16 hours ago.